Leveraging Document AI technology across your enterprise

While companies are always facing external challenges, the past year has been especially formidable. The global coronavirus pandemic has changed how many of us work and has increased the number of economic risks for many businesses. External pressures can quickly change business priorities, and one way to manage these more effectively is with technology. Financial services firms have faced many challenges, including falling interest rates, the COVID crisis and Brexit. These issues have triggered a renewed focus on digital transformation.

Like so many businesses, financial services firms are trying to cut costs, and these cost-saving measures often result in reduced productivity. But the savviest firms are embracing technology to help them through these difficult times. Whether they need to mitigate credit risk, manage regulatory compliance, or meet other requirements, firms must find ways to do more with less to remain competitive.

External pressures create huge administrative burdens

The administrative burden for financial services firms is enormous. For example, banks and lenders now have a considerable challenge in reviewing their back books. They may have thousands of loans, and each agreement may need to be reviewed in relation to recent events and regulatory changes. This puts additional time-sensitive demands on organizations to analyze their documents. Data needs to be located and compiled from each contract, so the impact and business risk of changing market conditions and reforms can be accurately assessed.

The burden is compounded when you consider that potentially thousands of documents need to be examined at a level of granularity previously unrequired. A single loan agreement could be subject to a review of LIBOR-related language, including maturity date and fallback provisions, terms relevant to restrictions due to Brexit and pandemic-related clauses. The logistics of such exercises are complicated and require project management and tracking to ensure they are carried out effectively and deliver the necessary results within the required timeframes. And while external factors are fluctuating and evolving, so are your data needs. You need to do a thorough job of compiling information, so you have the salient data to hand but do it quickly so it can be acted upon before the situation changes or worsens.

In an environment where you lack resources and budget but need to act fast, manually reviewing documents is no longer an option. Fortunately, Document AI can help alleviate the burdens associated with reviewing, evaluating and gathering insights from thousands of documents. And once you’ve successfully implemented Document AI for one use case, it's quick and easy to apply it to other documents, data needs and processes.

Advancing your digital transformation efforts with Document AI

By using technology rather than people to do the cumbersome work of sifting through documents, firms are saving a substantial amount of time and money. Some of Eigen’s clients report a cost saving of 80% or higher compared to the cost of outsourcing manual document review. And time savings of up to 75% have also been reported. Once clients have seen the value they get from one application of the technology, they feel confident that it can handle other functional areas, use cases and address more internal process pain points. In fact, starting with one use case and expanding into others has become the norm for our clients.

Financial service firms are awash with contracts, agreements, prospectuses and paperwork in general. With so many documents, the opportunity to solve for multiple business challenges are plentiful. And those choosing to use AI to automate their in-house document review capabilities for one problem area, have taken a giant leap forward with their digital transformation efforts. For example, a global bank wanted to automate how they identified and managed contracts impacted by regulatory change. They had thousands of loan documents to review, and each one was taking a highly skilled specialist approx. 70 minutes per agreement to review manually. It would have been a prolonged and expensive exercise to complete manually. Instead, the bank used Eigen’s Document AI technology to extract answers from all their loan documents. The platform successfully extracted over 7,500 data points with the exercise completed in 75% less time at a fully loaded cost saving of 60%.

After this initial project's success, the bank used Eigen to automate its loan fulfillment processes to drive further efficiency gains and cost savings. Eigen’s technology is now being rolled out across other functions and use cases, delivering automation of repetitive, costly and human-error prone tasks. Document AI sits at the heart of the bank’s digital transformation program powering its information management, data quality, document processing and analysis automation efforts. Using APIs and plugins, data is seamlessly extracted, interpreted, transformed and delivered to systems across the bank. And with the easy-to-use platform, new data fields or questions can be added and trained quickly as external pressures and business needs change.

Scaling Document AI beyond short term challenges

At Eigen, we work with innovation, digital transformation and data management teams to help them solve the document-related aspects of their digitization programs and scale data extraction and analysis across their organizations. We can help identify and assess which use cases, document types and processes are good targets for Document AI and meet with your engineers and functional leads to determine requirements and dependencies. We work with clients to prioritize use cases and plan the implementation effort to ensure that the time to value is minimized and that benefits are quickly realized. If required, we also have a network of delivery partners and consultancy firms to call upon for subject matter expertise.

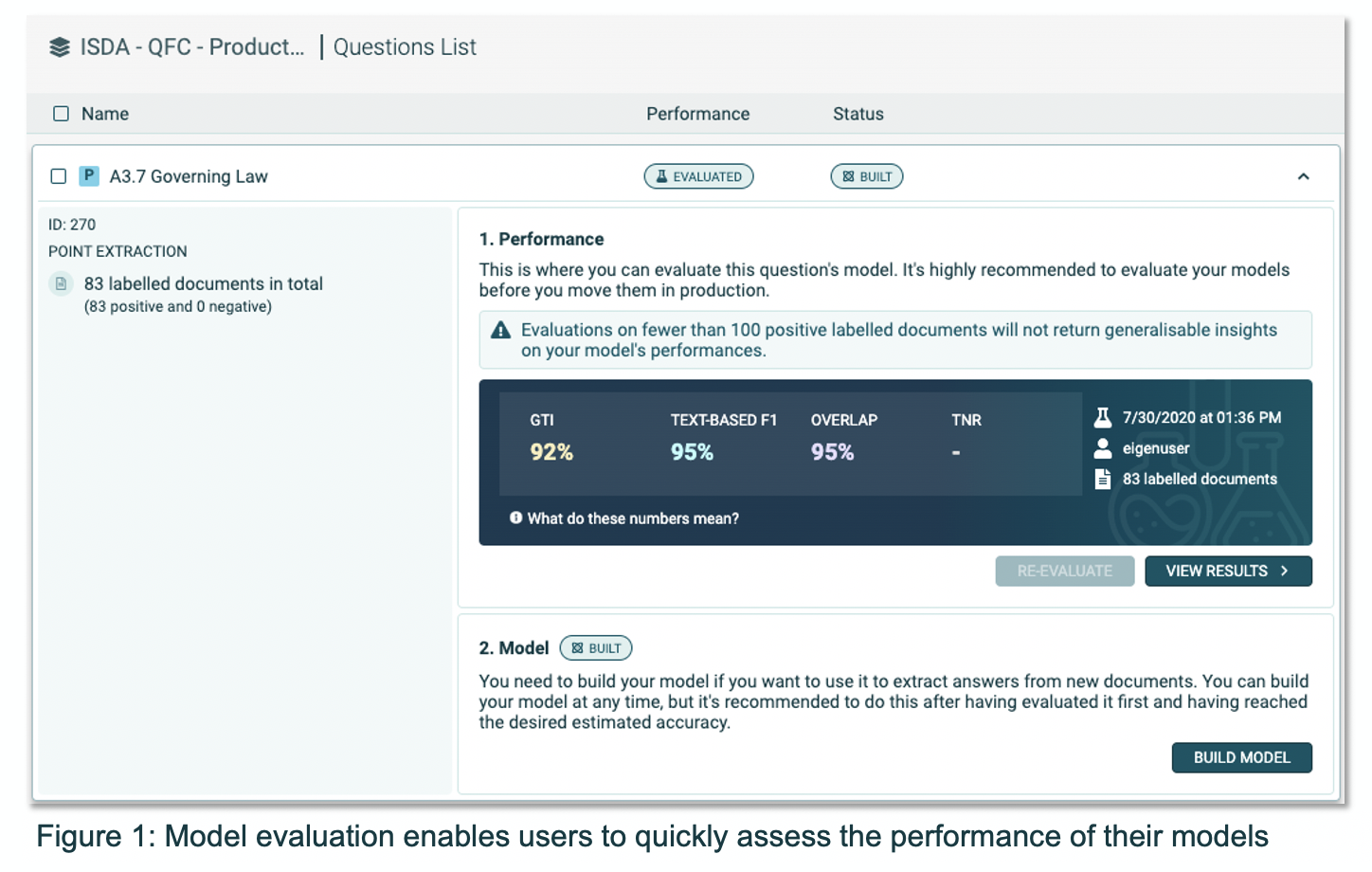

During the setup and training phase as well as ongoing post-implementation, we provide support and advice to make sure requirements are met, and the correct data is delivered. The platform guides non-technical users through the model training process, which can be handled in-house or by Eigen’s legal product consultants if resources are unavailable. It’s easy to gauge the model's performance with an in-built model evaluation tool showing you the accuracy levels attained for each field or question. A screenshot of the model evaluation tool is shown below. Using the tool to evaluate the performance enables clients to retrain and tweak the results until the desired accuracy is achieved before moving into full production. Clients have complete control over the data output so they can handle future changes as necessary.

The platform's flexibility and simplicity and the transparency of results make leveraging the technology across multiple use cases easy. New models can be trained to handle more document types, and existing models can be updated as data needs change. The platform can be used to scale operations, automate processes and drive cross-functional efficiencies. Companies handling large volumes of documents have an almost endless list of possibilities and functional areas across your enterprise can benefit from streamlined or automated processes.

The Document AI future is now

Document AI is increasingly becoming part of many firms’ digital transformation tech stack, enabling them to eradicate their teams' need to review documents or manually locate information buried in contracts. As a result, these firms are reaping the cost and time-saving benefits of automation of their everyday tasks.

Find out how Document AI can drive efficiencies across your enterprise. Request a demo of our platform to find out how we can help you with your use cases.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018