Loan documents to manage risk in a credit cycle downturn

For leveraged loan lenders, now’s the time to dig deep into your leveraged loan documents to mitigate increasing risks.

Since the end of the last financial crisis, there’s been a slow but pronounced trend tipping the balance in favour of flexibility for borrowers. This shift has eroded many of the controls lenders have historically had.

For many years, economic stability and the search for yield has made this a rational trade-off. But the coronavirus crisis and the ensuing market dislocation is forcing lenders to address potential vulnerabilities in their loan agreements. Now is the time for lenders to carefully examine the paperwork and reinstate some controls, to the benefit of borrowers as well.

Pressure points

In normal times when economic conditions are more stable, the effort and cost of analyzing all the agreements within your portfolio outweighs the benefit. But as market tensions mount due to coronavirus, lenders are now forced to review their documentation to understand the best course of action to take in the event of defaults.

With pressure on Q2 earnings in many sectors and concerns that worse might follow, borrowers may seek additional funding and amendments to their financing terms. Banks, private credit funds and other investors need to look in detail at their loan portfolios, to assess the risks and opportunities at an individual loan-level.

When the music stops, look at the docs

Historically this has been a manual and labour-intensive process: one reason, maybe, why lenders have tended to take a reactive approach to credit market distress. Technology now allows us to make the process of getting a handle on the terms much easier and quicker. The documentation, and the terms within them, offer lenders a key early-warning system to protect their investments, one they currently cannot afford to ignore.

A good example of where lenders are currently at a disadvantage is the trend towards “covenant-lite”. Deals with no maintenance covenants (“covenant-lite” or “cov-lite”) or loosened covenants (“covenant loose” or "cov-loose") have become the norm in both syndicated loan and private credit markets in the US and Europe. According to LCD, the cov-lite share of the S&P/LSTA Leveraged Loan Index is currently at a record high of 82%, up from 15% at the end of 2008(1). Because covenants typically act as an early warning sign to lenders of deteriorating conditions in the borrower's business, the greater prevalence of "cov-lite" or "cov-loose" loans means lenders need to be more proactive in communicating with borrowers. If they don't, they risk being too late to find a workable solution before default occurs.

How our technology supports lenders in gaining visibility

Our latest analysis and white paper was produced using data extracted from credit agreements using our proprietary natural language processing (NLP) machine learning platform. We created an “Eigen mock portfolio” of 130 leveraged loans and ran the individual credit agreements through the Eigen platform to answer questions pertaining to covenants and clauses. Our platform was able to successfully interrogate the documents and produce data in a structured and usable format.

Producing granular data on the loans within a portfolio helps lenders make informed decisions and provides the foundation for due diligence. This prepares the ground for any renegotiation of terms to put both lenders and borrowers in the best possible position during this current market volatility.

The “Eigen mock portfolio” is comprised of 130 publicly available LSTA-style syndicated and bilateral first lien credit agreements. Using the Eigen platform, we analyzed all 130 agreements to assess a number of terms that are critical to lenders decision-making now. This real-time snapshot of data flags trends which could be of interest to lenders highlighting areas they may need to address within their own portfolios. Critically, the document review process can be completed in a matter of days using NLP, as opposed to weeks or even months for manual processing depending on the size of a given portfolio.

The document clauses we analyzed included covenant packages, cure rights, cash leakage loopholes, amend-to-extend options and transferability restrictions.

We’ve highlighted below two of the five findings from the white paper, which also demonstrates how NLP technology provides fast and useful insights to lenders:

- Excess cash flow sweeps

Excess cash flow sweeps are the use of a company's excess cash flow to pay outstanding debts ahead of payment due dates, helping companies reduce liability as well as pay down debt ahead of schedule.

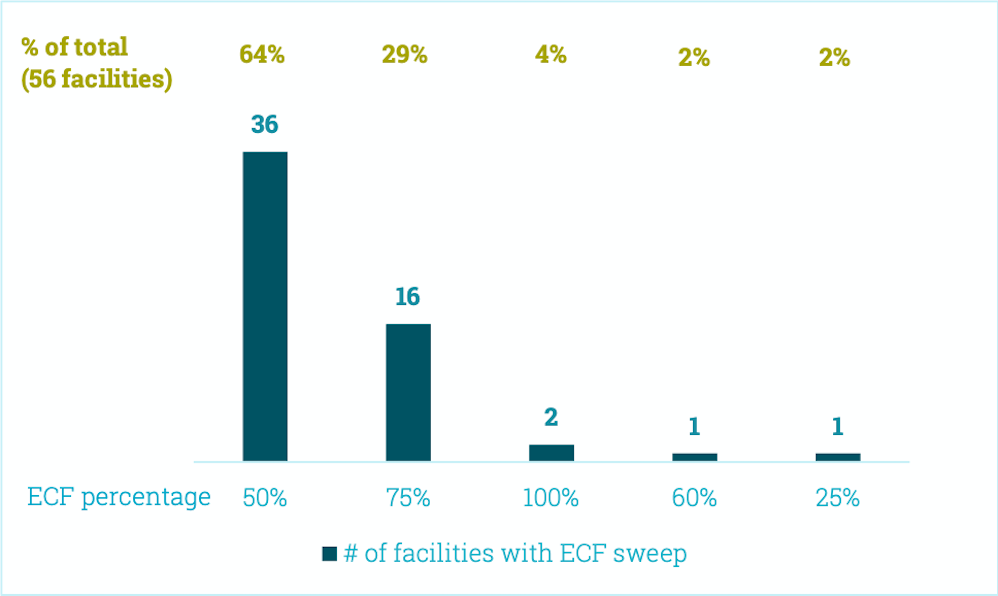

In US term B loan agreements, borrowers are usually required to prepay term loans using a percentage of excess cash flow from operations. Historically, the initial sweep percentage was applied irrespective of the post-sweep leverage. A more recent borrower-friendly innovation is to apply a lower sweep percentage as the borrower deleverages. Typical prepayment step-down levels are often set at 50%, 25% and 0%, with the leverage level at which the prepayment percentage first steps down set with a comfortable buffer below the opening leverage.

This more favourable approach to cash sweeps has been driven both by the convergence with the high yield documentation and the prominence of direct lending funds motivated by reinvestment returns. Private credit funds prefer excess cash flow to be reinvested back into the business for value-enhancing activities in order for their investments to be earning a return for as long as possible instead of an early deleveraging which is typically preferred by banks.

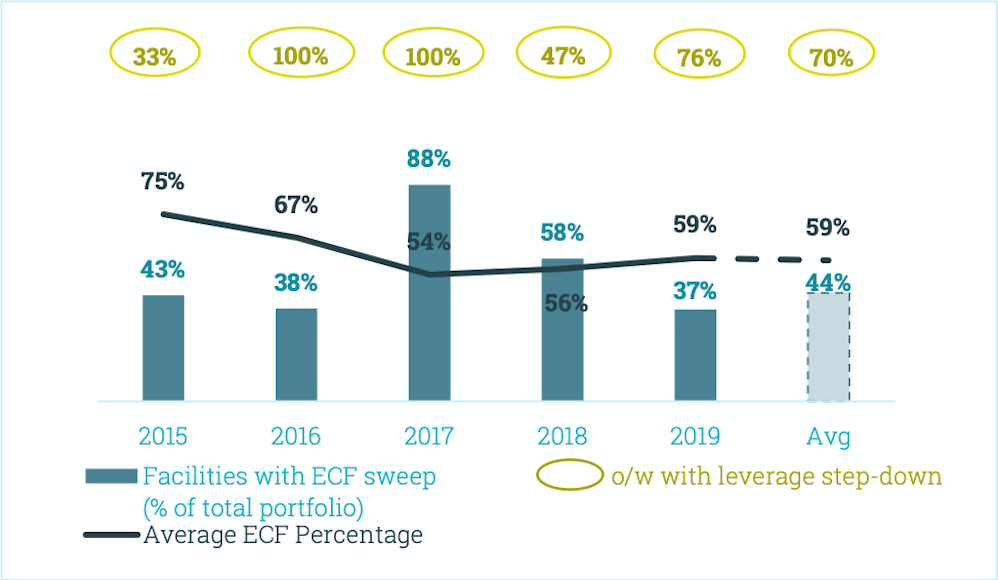

In the Eigen mock portfolio, c.45% of credit facilities had a built-in ECF sweep mechanism in place with an average initial sweep percentage of c.60%. Most agreements had an ECF sweep percentage set at 50%, followed by agreements with an ECF percentage of 75%. Thresholds set at 100% and /or at the lower spectrum (25%) were relatively rare.

It may be worthwhile for bank lenders to reset the ECF sweep thresholds to a higher level in order to limit cash leakage.

- Equity cure rights

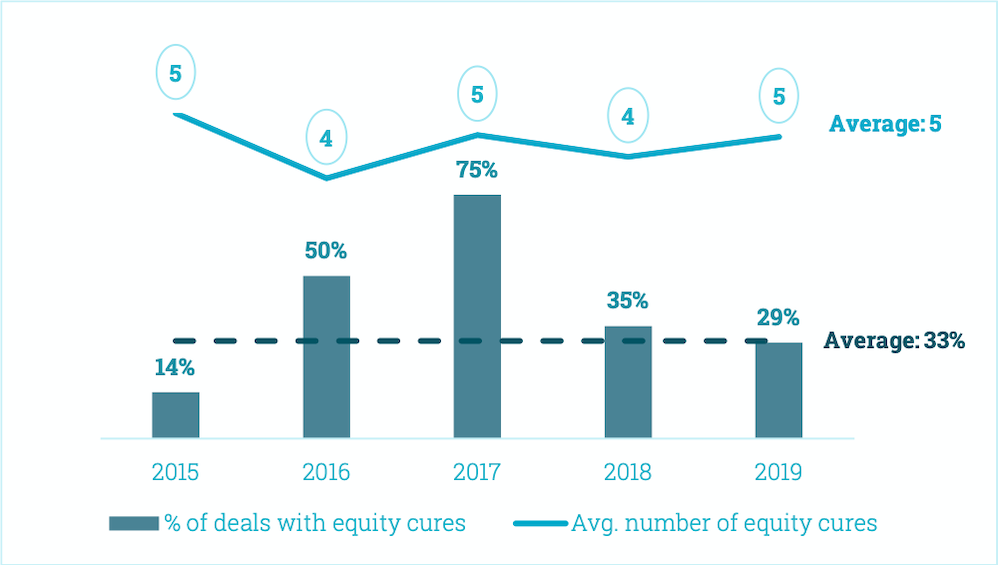

A common loan provision in sponsor-backed deals, equity cure rights allow a cash injection to avoid default and are an area where lenders need visibility into the terms within their agreements. It is important for the lender to know the number, frequency and permitted treatment of equity cures to ensure that the cure right is used to address a short-term performance dip triggered by COVID-19 instead of a severe longer-term problem with the borrower’s business.

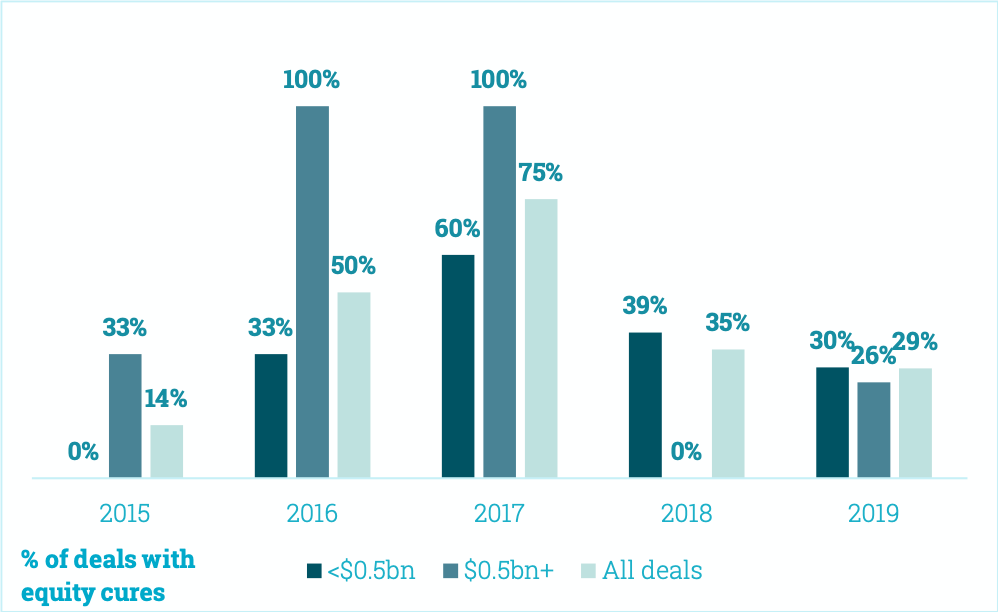

Among the credit agreements analyzed, we identified that 33% permitted equity cures with the cap on the number of cures averaging at five times over the life of a loan. The number of smaller deals containing cure rights almost doubled by 2017 with a significant push back observed at both ends of the market in the last two years.

These are just two examples of the findings and trends identified using data extracted by Eigen. The NLP technology can be used to quickly examine key clauses in all the loan agreements within a lender’s portfolio, giving lenders the tools they need to anticipate problems, recalibrate or renegotiate covenants and amend clauses.

The extra visibility this provides ultimately has the potential to benefit everyone in the credit system by allowing for earlier anticipation of stress points and facilitating meaningful conversations and renegotiations in good time.

If you would like to learn more about the findings in our white paper, and how our platform can help you to better manage your loan portfolio, please watch our on-demand webinar.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018